Navigating the Future (1/5) Transitioning to Sustainable Fuels in Maritime Shipping

Platform Zero is dedicated to promoting green practices in the maritime and energy sector. Through informative articles based on research and expert interviews, we aim to educate readers on sector trends. If you’re an expert interested in contributing, contact us at info@platformzero.co!

At the verge of change

This is the first of a series of articles describing the issues with the current way that the maritime shipping industry is fuelled, and further exploring how the following four alternative fuel types may help to reduce pollution and safeguard marine biodiversity: hydrogen, methanol, LNG and ammonia.

Maritime shipping, accounting for around 3% of global greenhouse gas (GHG) emissions, is under pressure from stringent environmental regulations aimed at reducing emissions. As an example, the EU’s Fit for 55 package mandates the industry to cut emissions by milestones: (relative to 2020 levels of emissions): by 2% as of 2025, 6% as of 2030, 14.5% as of 2035, 31% as of 2040, 62% as of 2045 and 80% as of 2050. Despite its significant GHG emissions, ocean shipping is vital, transporting 80% of global goods (Statista Research Department, 2024). The shipping industry has a relatively high energy efficiency due to economies of scale as large container ships are able to carry significant quantities of cargo.

To comply with new regulations, the industry is exploring various strategies, including the adoption of alternative fuels. This paper provides a general overview of the importance of alternative fuels in reducing maritime emissions and highlights the direction the industry is taking. Future articles will delve into specific alternative fuels, examining their challenges and opportunities.

Current state of the maritime shipping industry

Over 95% of ships today are powered by internal-combustion engines using heavy fuel oil (HFO), since the 1960s. HFO is a highly polluting, tar-like, substance derived as a residual of processing crude oil, which causes it to be contaminated with compounds such as sulphur and heavy metals. The combustion of HFO produces smoke called “black carbon,” particulate matter rich in toxic substances such as sulfur and nitrogen oxides (SOx and NOx). Maritime shipping is in fact the primary contributor to black carbon in the Arctic Circle, a region particularly vulnerable as the particulate matter absorbs heat due to its colouring, leading to an increase in ice melt and global warming. In addition, particulate matter of emissions of course also negatively impact the health of people living close to maritime and port clusters.

These are all reasons why one might consider shifting from HFO to alternative solutions. However, HFO tends to be relatively inexpensive; typically 30% cheaper than distillate fuels such as marine diesel oil or marine gas oil and currently far cheaper than sustainable alternatives. Therefore, the industry has established systems to extend the use of HFO for profit optimisation. An example can be given through scrubbers. To combat air pollution, Emission Control Areas (ECA) have been established, requiring shipowners to install scrubbers that remove sulfur (contained in HFO) from exhaust. The removed sulphur is collected into wash water, which later gets discharged at sea or ports, often with little treatment. Thus, without making any actual positive impact, vessels are encouraged to continue using the inexpensive, but highly polluting, HFO – ultimately delaying the implementation of alternative fuels. Luckily, through innovation scrubbers tend to develop (better) filtering solutions, lowering the impact on the ocean. New systems are required to support the shift from HFO and other fossil fuels to sustainable alternative solutions.

Future perspectives

With most industries looking to reduce their carbon footprint, the maritime shipping industry cannot continue to rely on HFO. To reach economic viability for alternative solutions, programs and regulations can support the industry in the right direction. Various regulations focus on reducing percentages of emissions every year. This mainly results in optimising energy usage. A great start, but much more will be needed to shift away from fossil fuels.

Examples of regulations that help changing the system include FuelEU Maritime and the Emission Trading System (ETS). FuelEU Maritime regulation creates a system that promotes the use of cleaner fuels by establishing targets for greenhouse gas (GHG) intensity for fuels used by ships. It focuses on reducing carbon intensity per unit of transport work. Companies that exceed their targets and are “Over-compliant” (i.e., have lower GHG emissions than required) can sell credits to companies that do not meet their targets. A similar system targeting various markets it the ETS. ETS imposes emissions limits on industries, including maritime transport. In short: a cap-and-trade system with a fixed cap on total emissions.

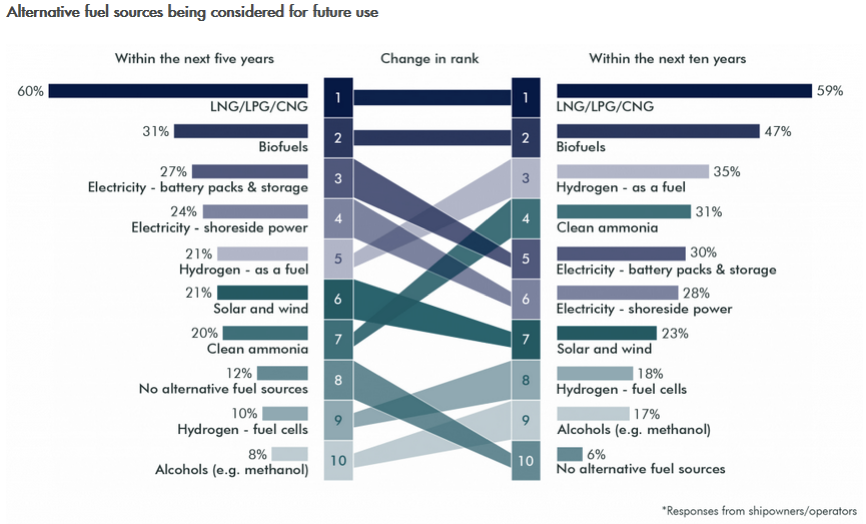

Looking to innovate, different fuel types are being explored and invested in. Among the most promising alternative fuels are ammonia, hydrogen, and methanol, each offering distinct advantages and challenges. Research shows that shipping operators currently consider Liquified Natural Gas (LNG) as the most likely replacement for HFO both in the short and medium term, as seen by graph 1. However, it is important to note that LNG can be regarded as an outlier within this list since it is a fossil fuel and the only fuel type with a mature and established market.

Bio-fuels and e-fuels

In addition, e-fuels and bio-fuels form sustainable versions of current fuels. E-fuels, or electrofuels, are synthetic fuels produced using renewable electricity to split water into hydrogen and oxygen, which is then combined with captured carbon dioxide to create fuels like synthetic gasoline, diesel and methanol (e-methanol). They are nearly carbon-neutral and compatible with existing infrastructure but are energy-intensive and currently more expensive to produce. Biofuels are derived from biological materials such as plants and algae, with types ranging from first-generation (made from food crops) to third-generation (produced from algae). They offer renewable energy sources and can reduce greenhouse gas emissions but may raise sustainability concerns, especially regarding land use and food security.

An introduction to alternatives

Ammonia is gaining attention as a potential maritime fuel due to its zero-carbon emission profile when produced from renewable sources. It can be used directly in internal combustion engines or fuel cells. However, the toxic nature of ammonia and the need for new infrastructure and safety protocols are significant challenges that need to be addressed.

Hydrogen, another zero-carbon fuel, boasts a high energy density and can be used in fuel cells to produce electricity with water as the only by-product. Hydrogen’s potential to drastically cut emissions makes it an attractive option for the maritime industry. Nonetheless, the current lack of widespread re-fuelling infrastructure and the challenges associated with storing and transporting hydrogen efficiently remain significant hurdles.

Liquefied Natural Gas (LNG) is a more established alternative fuel, already in use in various maritime applications. LNG burns cleaner than traditional marine fuels, producing significantly lower levels of sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter. While it is a fossil fuel, LNG is considered a transitional fuel that can help reduce emissions in the short to medium term as the industry moves towards zero-carbon options.

Methanol, which can be produced from renewable sources, is easier to handle and store compared to hydrogen and ammonia and can be used in existing engine technologies with minor modifications. Methanol’s relatively lower energy density compared to traditional marine fuels means that ships require larger storage volumes, which is a logistical challenge that must be overcome.

These alternative fuels, while promising, each come with their own set of technical, economic, and regulatory challenges. The maritime industry’s shift towards these fuels will require significant investment in new technologies, infrastructure, and training. Complex value chains must be built to support the establishment of a novel fuel type, and will inevitably impede the development of competing fuel types.

Our next article in this series will discuss more in-depth why LNG seems to become the most likely replacement of HFO within the next 5-10 years, exploring its advantages and disadvantages, while shedding light on what is needed by other types of alternative fuels to sway the opinions of senior leaders in the maritime shipping sector.

Enthusiastic about this topic? Contact us at info@platformzero.co and we can tell you more about it!