Analysing 60 start-ups on decarbonisation in shipping: Unchartered waters and the need for proven data

Platform Zero analysed 60 start-ups focused on decarbonisation of the shipping industry because currently, shipping is not on track on reaching the initial GHG strategy of 50% reduction compared to the 2008 baseline of the IMO. The maritime industry now accounts for a significant 3% of global carbon emissions. This number is expected to increase to 10% if business-as-usual is continued. This is reiterated by the fact as stated by Maersk Mc-Kinney Møller Center that currently only 33 out of the 94 (35%) major shipping companies have set clear decarbonisation targets in terms of net-zero for 2050. These facts demand us to research companies that engage in signifying their positive impact. In a consolidated industry as the shipping industry start-ups play an important role in influencing larger organisations to change their course and facilitating the goals of the IMO.

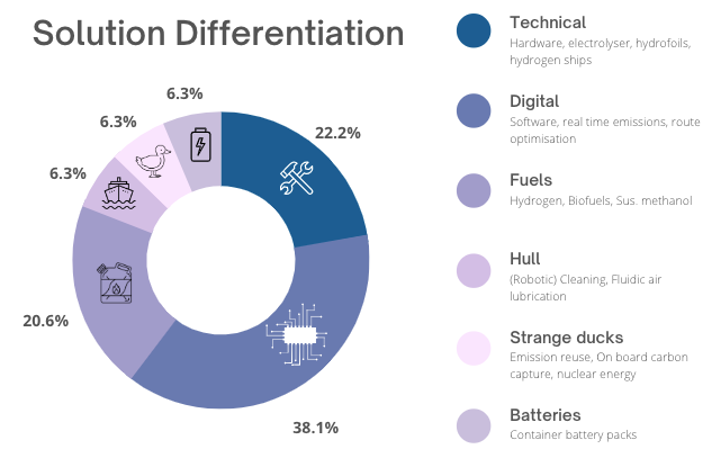

A large variety of solutions with ‘digital’ in the lead

We have defined six segments amongst which the 60 start-ups can be divided: technical, digital, fuels, hull, batteries, and strange ducks. As can be seen in the pie graph the largest share (38.1%) of companies is linked to a digital solution for decarbonisation, which makes sense because McKinsey’s independent research center has identified that this has the largest reduction potential for the sector between now and 2030. Many of these digital start-ups focus on optimization. This could be the optimization of sail routes, fuel consumption optimization with the help of real-time emission data, and bunker and port-call optimization which eliminates waiting time before docking.

Start-ups classified under the technical umbrella are the second-largest group which contains a variety of different innovations: the use of hydrofoils, making ships ‘float’ above water to reduce water resistance, the replacement of tugboats with autonomous thrusting robotics, and on-board hydrogen generators. These innovations are merely a handful of the large variety of technical innovations from our list that stimulate decarbonisation in shipping. Third on the list are the innovations connected to fuels. These resemble 20.6% of the start-ups in our list and consist mainly of innovations related to the production of hydrogen, biofuels, and sustainable methanol. Although these fuels could have a great impact on the reduction of carbon emissions in the shipping industry, unfortunately, one of the main challenges with this is the CAPEX and complexity of realising a worldwide infrastructure to make these fuels operational.

The following three segments all account for 6.3% of the total list. The fourth category we identified were start-ups specifically related to a ship’s hull. Significant emission reduction can be attained by streamlining the outside of a ship. Robotic hull cleaning and the use of air as lubrification during sailing are ways to reduce water resistance. Fifth are innovations related to the use of large battery packs on container ships. Like fuels, under the condition of renewable energy, the use of batteries is very successful in decarbonising shipping, however current battery packs limit a ship’s sail distance. Finally, the group of strange ducks are start-ups which can be classified under multiple or none of the above-mentioned segments. Examples are start-ups related to onboard carbon capture, or onboard nuclear-electric power packages.

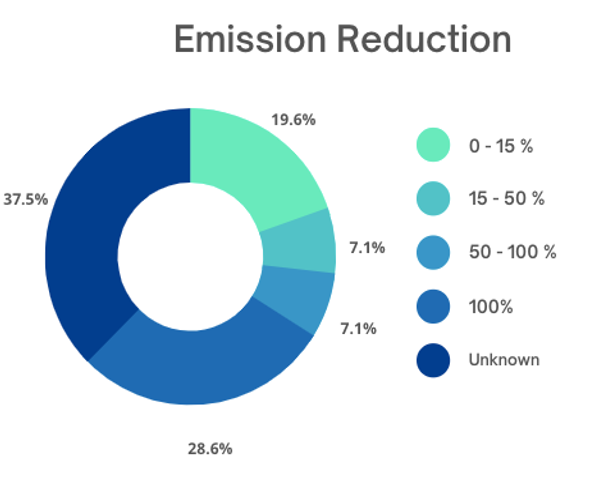

Decarbonisation would benefit from more hard data

Even more important than the types of solutions, obviously is the climate impact (decarbonisation) that these solutions are making. A classification of five groups can be made. We observed that the gross of the start-ups (37.5%) state they decrease emissions one way or another however what percentage exactly is often unknown. Contrary to this group is the second largest group of start-ups (28.6%) that communicate a 100% reduction in emissions with their innovation. This segment mostly consists of companies focusing on hydrogen, sustainable methanol, and battery packs functional for maritime. Obviously, we are critical on these claims since it needs to consider all emissions. The third group represents a decarbonisation rate of 0-15% and consists mostly of companies focusing on digital and hull innovations. Optimization of the current ship plays a central role here. The other two groups are not represented by a typical solution.

Three companies drawing attention

This Rotterdam-based start-up provides a total solution for emission-free sailing with an open-access infrastructure: interchangeable battery containers charged with renewable power, charging stations, technical support, and an innovative pay-per-use-based payment concept. A company with great plans to decarbonise inland shipping.

Ayro develops wingsail technology usable in the maritime industry. This French start-up is an eye-catcher. It is equipped with 30 metre-high ‘wings’ and makes a serious positive impact. Its technology ensures a decrease in carbon emissions and reduces fuel consumption by up to 40%. Their first grand project in shipping will sail in 2023.

3. Boundary Layer Technologies

BLT, no not the sandwich but the hydrofoil, hydrogen-powered container vessels developed in San Francisco. This vessel has minimum water resistance and could act as a substitution for air freight due to its speed. An interesting concept to keep an eye on.